Moonshot #3

ispace shares plunge, SpaceX to put another $2 billion into Starship, and Airbus debuts LOOP

Hello Continuum readers and Celestial Citizens,

Welcome back to Moonshot where we will give a bi-weekly rundown of all the private sector space news. Also, if you haven’t already, consider becoming a paid subscriber ($6/month) so you can get past that pesky paywall and read the full Moonshot post!

And here is the commercial space beat…

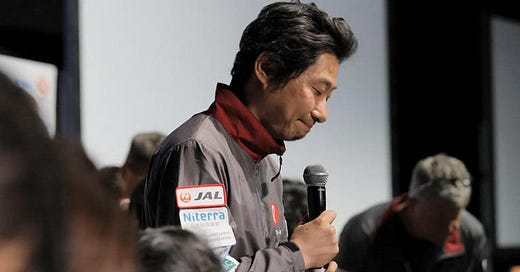

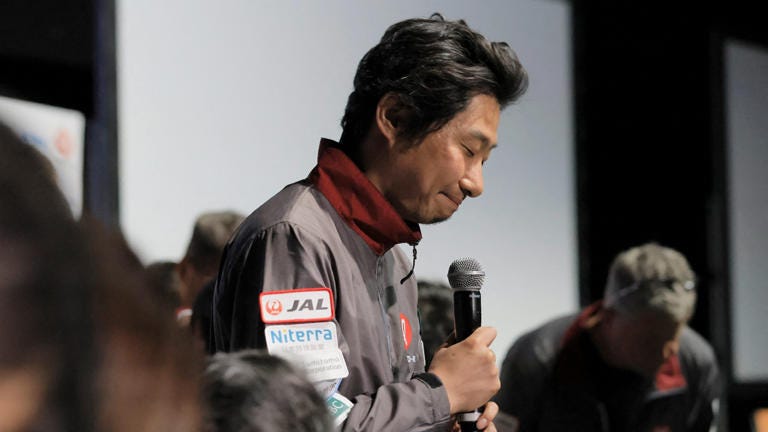

ispace – We reported on the loss of ispace’s Hakuto-R Mission 1 (M1) lander last Tuesday, and it appears the crash was due to the lander unexpectedly accelerating as it approached the moon — likely a result of its altitude measurement system miscalculating the remaining distance to the surface. "It apparently went into a free-fall towards the surface as it was running out of fuel to fire up its thrusters," said Chief Technology Officer Ryo Ujiie. Adding further insult to injury, the Tokyo-based company’s shares fell precipitously and resulted in a loss of almost half the company's value or about $600 million after 3 days of trading.

SpaceX – The fallout from the destructive Starship launch continues, as CEO Elon Musk took to a subscriber-only chat on Twitter this past Saturday. During the chat, he revealed that it took about 40 seconds longer than expected for explosives to rupture the vehicle’s tanks — despite the flight termination system being initiated. I don’t know about you, but 40 “Mississippi’s” feels like a long time to wait, when a massive rocket is flying drunk overhead. He also downplayed the plume of dust and debris as well as the damage to the launch pad and setting fire to a portion of Boca Chica State Park. In fact, Musk appears to be doubling down on the company’s Starship efforts by announcing that he is targeting another launch in two months’ time and will be putting another $2 billion into Starship this year alone. Amidst all of the question marks around Starship, SpaceX did celebrate a successful launch of 46 more Starlink satellites from Vandenburg this past Saturday and then another successful liftoff of its Falcon Heavy rocket from Launch Complex 39A at the Kennedy Space Center last night. The Florida launch was initially delayed due to severe weather including a lightning strike to the launchpad tower — resulting in the SpaceX team performing a series of checks to the rocket, payloads, and boosters.

Blue Origin – Bezos’ company is now one of 12 companies to enter into a quid pro quo-type partnership with NASA, where the company will provide technologies towards the agency’s Moon to Mars initiative, and in return, the agency will share its decades of expertise towards company products. Odds are the partnership will be a fruitful one, as Blue Origin has already established a working relationship with the U.S. space agency, such as with a precision landing system back in 2020.

Airbus – European multinational corporation Airbus excited space tourists this week with visuals of LOOP, a sleek module made to fit inside a future heavy-lift rocket like the Starship. Touted as the next ISS, LOOP would (in theory) have a greenhouse, gym and gravity simulator to provide ultimate comfort for space travelers.

Sierra Space – Also in the market of LEO habitation, Colorado-based Sierra Space shared a scaled model of their Large Inflatable Flexible Environment (LIFE) with partner ILC Dover during this year’s Space Symposium. The LIFE model offers a lightweight alternative to more rigid modules like the ISS. Sierra Space is another of the 12 companies partnered with NASA as part of the Moon to Mars initiative.

Astrobotics – Speaking of delays, following an explosion during a ULA rocket test last month, Pittsburgh-based Astrobotics has had to pump the brakes of their lunar lander while they wait for its ride to shape up. Last Tuesday, Astrobotics CEO John Thornton inspired confidence, calling the explosion – er, "rapid unplanned disassembly," in his words – the reason for this type of testing in the first place. With a new chance at becoming the first private venture to land on the moon, the company is only committing to a launch delay of a month or two for the anticipated Peregrine lander, targeting June/July. Diversifying its partnerships, Astrobotics also just contracted a SpaceX Falcon Heavy for a future lunar lander launch in 2026.

Rocket Lab – Having made great strides in its rocket recovery strategy, New Zealand’s Rocket Lab just announced plans to reuse a pre-flown Rutherford engine on an upcoming Electron launch. The company has an ambitious slate of 15 Electron launches this year, two of which will carry NASA’s TROPICS cubesats recently transferred from Virginia to New Zealand in an effort to get them in the sky before hurricane season. And speaking of being hasty, the company also announced a suborbital vehicle titled HASTE (Hypersonic Accelerator Suborbital Test Electron) which they imagine could garner interest from defense agencies around the world. As of Sunday, the launch of NASA’s TROPICS cubesats was delayed due to bad weather.

Continuum Podcast: Starship Live Launch Reaction

ICYMI, we released a special live recording of Continuum podcast while watching the first launch of SpaceX’s Starship. Co-hosting with our founder, Britt Duffy Adkins, is science communicator and creator of the YouTube Channel Space But Messier!, Tony DiBernardo.

Firefly Aerospace – After Russia’s invasion of Ukraine, Northrop Grumman dumped Russian RD-181 engine for their Antares rocket – intended to fly for the Space Force in approximately 2025 – in favor of Firefly’s Miranda engines. In order to compete with companies like Relativity Space and Rocket Lab, Firefly's two-stage vehicle will have to lift approximately 16,000 kilograms, or over 35,000 pounds. With this “Next Generation Medium-Lift Vehicle,” the Texas-based company hopes they and their partner Northrop Grumman will procure a Phase 3 contract with the U.S. defense department.

Astra Space – Also working with the Space Force, California-based satellite launch company Astra. Holding its very own SpaceTech day last Tuesday to discuss progress on their new launch vehicle, Astra used the opportunity to celebrate a $11.5 million contract with the U.S. defense department to launch “experimental” payloads. Colorado-based company Ursa Major will supply the upper-stage engine for this new Astra rocket. Adding to its recent wins, Astra announced last Thursday that it won an “order for five of its Astra Spacecraft Engines from Apex, a company developing a line of standardized smallsats.”

Exotrail – The French propulsion company recently announced that it won an order for its spaceware Hall-Effect thruster from South Korean satellite manufacturer Satrec Initiative. The electric propulsion system will be used on an Earth observation satellite for the South Korean government.

LeoLabs – American aerospace company LeoLabs’ phased array radars are really saying “never let them know your next move.” The company touted a maneuver detection dashboard at this year’s Space Symposium that picked up 30 Chinese, Iranian and Russian satellites in LEO. The company hopes the technology reduces the “likelihood of conflict and debris-generating activities in space.”

Virgin Orbit – Finally completing its investigation into the launch failure that threw the company into the financial deep end, Virgin Orbit reveals the “root cause” to be a “fuel filter that dislodged in the propulsion system and made its way into the Newton 4 engine.” With this new intel, the company expresses optimism for a new design that could be ready to launch from Mojave later this year – if only a buyer jumps on board (figuratively speaking, of course).

Maxar – The primary provider of the U.S.’s commercial electro-optical imagery, Maxar recently revealed plans to launch their WorldView Legion satellites as early as this summer. This announcement comes after years of delays, in part due to pandemic production shutdowns as well as transportation limitations from Ukraine. While the war may have created logistical limitations for the company, it also created an opportunity to quench a new thirst for not only optical imagery but technologies like synthetic aperture radar (cloud x-ray vision, basically) and radio frequency mapping – both of which Maxar is investing in. Making money moves this morning, Maxar Technologies share price ticked upwards 0.5% following a delisting notice as its December 2022 agreement to be acquired by Advent International inches closer.

Keep reading with a 7-day free trial

Subscribe to Celestial Citizen to keep reading this post and get 7 days of free access to the full post archives.